How the increased minimum wage will affect your business costs

Have you factored in the rise in the National Living Wage from April 2024? Talk to us about managing your business costs and remaining profitable.

Although inflation is now on a downward trend, the sharp cost rises over the last 18 months are baked in. Energy prices are increasing again and the overall economic outlook isn’t very encouraging.

The good news is that by acting now to manage these increases you can stay on top of these costs. And with a proper financial plan, you can keep your business turning a profit.

A rise in the National Living Wage and Minimum Wage

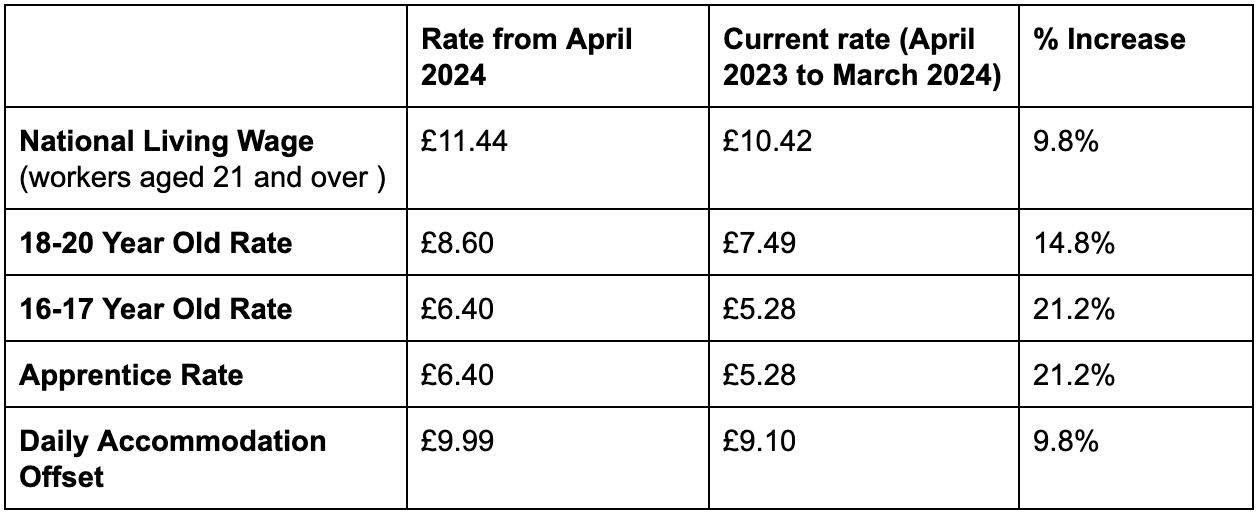

The rise in the National Living Wage and the National Minimum Wage (NMW) recommended by the Low Pay Commission was accepted by the Government in November 2023. This increase means that the NLW rises by 9.8% to £11.44 from 1 April 2024.

The size of your overall wage increase will depend on the age of your employees and whether they’re currently working as part of an apprenticeship scheme. However, the increase in your payroll costs is something to factor into your financial planning for the year.

The new NLW and NMW rates from 1 April 2023 are:

Time to review your pricing?

Is it time to put your prices up? Ideally, your business should increase costs by a tiny amount each year, rather than by a big jump every five years, for instance. Small increases help prevent price shocks for customers, and keep your business in line with the rest of the market.

Can you also cut costs?

If you don’t think increasing your prices is an option, or you still need to make more of a change, you may need to cut back your spending. We look at your business line by line, so we can help you identify areas where you might be able to trim the fat.

Talk to us about managing your business costs

Keeping on top of rising business costs in 2024 will be a challenge. But with the right mindset, planning and forecasting, you can stay one step ahead of the curve.

Talk to us about helping you prepare a financial forecast for the next year or two to help you take control of the current economic headwinds.

Get in touch to talk about your financial future.

Get in touchRelated Articles

Alternative routes to funding: how to bring capital into your business

Capital is the fuel that fires your business. But when you need extra capital, what are the alternative routes to fast and efficient funding?

Read On

New routes into the defence sector: funding for UK tech companies

The UK Government is looking for the next defence unicorn, with new routes into the UK defence market for small UK-owned tech companies.

Read On

5 things your balance sheet can tell you about your finances

Your balance sheet is a key financial statement to understand.Here are 5 ways your balance sheet can keep you informed about your finances

Read On